I’m thrilled to bring you this comprehensive analysis on one of the most pivotal energy sources of our time: Natural Gas. As someone who has spent countless hours studying the intricacies of the energy sector, I can confidently say that the future of Natural Gas is not just promising—it’s essential. In the sections that follow, I will not only delve into the significance and history of Natural Gas but also detail three publicly traded companies that are leading the charge in this industry.

Understanding the Energy Landscape

Before we delve deep into the world of Natural Gas, it’s crucial to understand the broader energy landscape. Energy is the lifeblood of modern civilization. From the electricity that powers our homes to the fuel that drives our vehicles, energy is omnipresent. The global energy market is vast, complex, and ever-evolving, with multiple sources vying for dominance.

The Significance of Natural Gas

Natural Gas is not just another energy source; it’s the backbone of modern civilization. Let’s delve into some numbers to truly grasp its importance:

- Global Energy Consumption: The world’s insatiable appetite for energy is evident. As of my last research, the world consumes approximately 600 quadrillion BTUs of energy annually. Of this, Natural Gas accounts for nearly 23%. That’s a staggering 138 quadrillion BTUs!

- Emission Reduction: In an era where climate change is a pressing concern, the role of Natural Gas becomes even more critical. Natural Gas emits 50-60% less carbon dioxide when combusted in a new, efficient natural gas power plant compared to emissions from a typical coal plant. This makes it a crucial player in the fight against climate change.

- Economic Impact: The ripple effect of the Natural Gas industry is vast. It supports millions of jobs worldwide and contributes significantly to the GDP of many nations. In the U.S. alone, the industry supports over 3 million jobs and adds more than $385 billion to the economy.

- Versatility: Natural Gas is a jack of all trades. Beyond electricity generation, it’s used in a plethora of applications, from heating homes to fueling vehicles and even producing everyday products like plastics and fertilizers.

A Historical Perspective

The story of Natural Gas is as old as civilization itself. Ancient cultures revered natural gas seepages, often considering them sacred. The Greeks, for instance, built temples around these seepages, believing them to be the divine manifestation of the gods.

Fast forward to the 19th century, and we see the first commercialization of Natural Gas in the United States. Initially used for lighting, its applications soon expanded to heating and cooking. The 20th century marked significant advancements in extraction techniques, notably the development of hydraulic fracturing or “fracking.” This revolutionized the industry, making previously inaccessible reserves available for extraction.

The latter half of the 20th century and the early 21st century have seen Natural Gas emerge as a dominant player in the global energy mix. Its cleaner-burning properties, coupled with abundant reserves and advancements in liquefied natural gas (LNG) technology, have positioned it as a key bridge fuel in the transition to a sustainable energy future.

Three Natural Gas Stocks to Buy Now

Now, as promised, let’s shift our focus to three publicly traded companies that are not just leading the Natural Gas industry but are setting standards for the entire energy sector.

- Cheniere Energy, Inc. (LNG)

- Description: Cheniere Energy, Inc. is primarily engaged in the liquefied natural gas (LNG) related businesses. They own and operate the Sabine Pass and Corpus Christi liquefaction facilities. Cheniere is a pioneer in the American LNG export industry and has established itself as one of the largest and most reliable LNG producers in the world.

- Why it’s promising: With the increasing global demand for cleaner energy sources, LNG is poised to play a significant role. Cheniere, with its strategic liquefaction facilities, is well-positioned to capitalize on this trend. Their long-term contracts with various global entities ensure a steady revenue stream, making them a stable investment in the energy sector.

- Royal Dutch Shell (RDS.A)

- Description: Royal Dutch Shell is one of the largest and most diversified energy companies globally. They operate in every segment of the energy industry, from exploration and production to refining, distribution, and marketing. Shell is also making significant strides in renewable energy and electric vehicle charging infrastructure.

- Why it’s promising: Shell’s diversified portfolio allows it to weather the volatile energy market better than most. Their investments in renewable energy show their commitment to a sustainable future, making them an attractive choice for investors looking for a blend of stability and forward-thinking.

- Hut 8 Mining Corp. (HUT)

- Description: Hut 8 Mining Corp. is one of the oldest and most innovative Bitcoin miners in the western hemisphere. While not directly a natural gas company, it is related to the energy sector due to its significant energy consumption for cryptocurrency mining.

- Why it’s promising: The future of energy is not just about its production but also its consumption. As digital currencies become more mainstream, the energy required for mining will increase. Hut 8, with its established infrastructure, is poised to benefit from this trend. Their commitment to sustainability and renewable energy sources for mining also makes them an intriguing choice for investors keen on the intersection of technology and energy.

In Conclusion

Natural Gas is not just an energy source; it’s the future. Its importance in the global energy landscape cannot be overstated. As we transition to a more sustainable future, Natural Gas will play a pivotal role in bridging the gap between traditional fossil fuels and renewable energy sources.

The companies mentioned above are not just leaders in the Natural Gas sector; they are pioneers, shaping the future of energy. Investing time, resources, and belief in them could very well be the key to a prosperous and sustainable future.

Remember, the energy sector is vast and ever-evolving. Stay informed, stay curious, and always look beyond the horizon.

Where to invest $500 Right Now?

Before you consider buying any of the stocks in our reports, you’ll want to see this.

Investing legend, Marc Chaikin just revealed his #1 stock for 2024…

And it’s not in any of our reports.

During his career of nearly 50 years, Marc Chaikin was one of the quantitative minds behind some of the most famous investors in history: Paul Tudor Jones, George Soros, Steve Cohen, and Michael Steinhardt.

Even the Nasdaq hired him to create three new indices.

And now he’s going live with his #1 pick for 2024.

You can learn all about it on Mr. Chaikin’s Website, here.

Wondering what stock he’s investing in?

Click here to watch his presentation, and learn for yourself…

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream… And by then, it could be too late.

Click here to reveal the name and ticker of Marc Chaikin’s no. 1 pick for 2024…

You might also like:

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

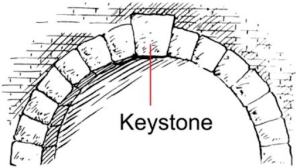

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

- No 1 Stock to Buy ASAP

- Secret Gold Back currency RUINING Biden’s plans for a digital dollar?