+ The Top 3 Cannabis Stocks to Buy Now

The year was 1933. America was in the throes of the Great Depression, and the streets echoed with the sounds of jazz and the clandestine whispers of speakeasy goers. For over a decade, the Volstead Act had turned the production and sale of alcohol into a criminal act. But as the clock struck midnight on December 5th, the 21st Amendment was ratified, ending the era of Prohibition. Almost overnight, the illicit bootlegging tunnels went silent, and the once underground alcohol industry burst into the mainstream, bringing with it a wave of unprecedented economic opportunities.

Among those who rode this wave was Joseph P. Kennedy Sr., the patriarch of the Kennedy dynasty. While the exact details remain shrouded in mystery, it’s widely believed that Kennedy amassed a significant portion of his wealth during Prohibition. By capitalizing on the imminent end of the alcohol ban, he secured a vast inventory of liquor, positioning himself perfectly for the post-Prohibition boom. As legal liquor flowed once again, fortunes were made, and the Kennedy family’s legacy was cemented.

Today, we stand on the cusp of a similar transformative moment, not with alcohol, but with cannabis. Just as the end of Prohibition opened the floodgates for entrepreneurs and investors in the 1930s, the ongoing wave of cannabis legalization presents a once-in-a-lifetime opportunity. The parallels are uncanny. Like the speakeasies of the Roaring Twenties, clandestine cannabis dispensaries have operated in the shadows. But as legalization spreads, these operations are stepping into the light, and in their wake, they’re paving the way for savvy investors to potentially reap significant rewards.

Recent Legislative Events in Cannabis

1. State Legalizations: The wave of cannabis legalization has been sweeping across the United States. States like New York, New Jersey, and Arizona have recently joined the ranks, legalizing cannabis for recreational use. Each state’s decision to legalize not only reflects changing societal perceptions but also the potential economic benefits from tax revenues and job creation.

2. Federal Cannabis Legislation: At the federal level, the winds of change are blowing stronger than ever. According to an article from McGlinchey, the U.S. House of Representatives has passed the MORE Act, which aims to decriminalize cannabis. While it awaits Senate approval, its passage in the House marks a historic step towards federal decriminalization.

Furthermore, as reported by NBC News, the SAFE Banking Act is gaining traction. This bipartisan bill seeks to expand banking services for legal marijuana businesses, addressing a significant challenge faced by the industry. The act is expected to undergo a markup session soon, and there’s optimism about its passage.

The Growing Acceptance of Cannabis

The cannabis industry’s growth isn’t just due to legislative changes. A shift in perception is playing a pivotal role. As highlighted by Forbes, outdated stereotypes about cannabis consumers are fading. Modern consumers, primarily women, are educated, health-conscious, and view cannabis as part of their wellness routine.

Moreover, the economic impact of cannabis sales in the U.S. is expected to hit $92 billion in 2021 and soar to $160 billion by 2025. States like California have already benefited from over $1 billion in tax revenue from cannabis. As the industry continues to grow, it’s poised to become a significant economic driver, especially in post-pandemic recovery.

Three Promising Publicly Traded Cannabis Stocks

- Canopy Growth Corporation (CGC):

- Overview: One of the largest cannabis companies globally, Canopy Growth has a diverse product portfolio and a strong presence in both medical and recreational cannabis markets.

- Technical Analysis: CGC has shown a steady uptrend over the past year, with strong support levels. The recent pullback offers a potential entry point for investors. The company’s expansion strategies and partnerships position it for future growth.

- Aurora Cannabis (ACB):

- Overview: Aurora Cannabis is known for its medical cannabis operations, with a significant global footprint.

- Technical Analysis: ACB stock has experienced volatility but has maintained key support levels. Its focus on cost-saving measures and capitalizing on international medical markets makes it a stock to watch.

- Tilray Inc. (TLRY):

- Overview: After its merger with Aphria, Tilray has emerged as a dominant player in the cannabis space, with a strong supply chain and distribution network.

- Technical Analysis: TLRY has shown resilience amidst market fluctuations. Its merger benefits are expected to reflect in its financials, making it a potential growth stock.

Conclusion

History has a curious way of repeating itself. Just as the end of alcohol Prohibition in the 1930s heralded a new era of economic prosperity and created fortunes for those poised to capitalize on it, the ongoing cannabis revolution offers a similar promise. The green gold rush beckons, and for investors with the foresight to see the potential, the rewards could be monumental. As we reflect on the tales of the past, like that of the Kennedy family’s rise to wealth, one can’t help but wonder: who will be the Kennedys of the cannabis era?

Where to invest $500 Right Now?

Before you consider buying any of the stocks in our reports, you’ll want to see this.

Investing legend, Marc Chaikin just revealed his #1 stock for 2024…

And it’s not in any of our reports.

During his career of nearly 50 years, Marc Chaikin was one of the quantitative minds behind some of the most famous investors in history: Paul Tudor Jones, George Soros, Steve Cohen, and Michael Steinhardt.

Even the Nasdaq hired him to create three new indices.

And now he’s going live with his #1 pick for 2024.

You can learn all about it on Mr. Chaikin’s Website, here.

Wondering what stock he’s investing in?

Click here to watch his presentation, and learn for yourself…

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream… And by then, it could be too late.

Click here to reveal the name and ticker of Marc Chaikin’s no. 1 pick for 2024…

You might also like:

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

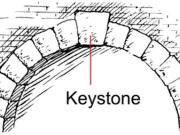

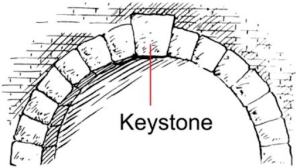

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

- No 1 Stock to Buy ASAP

- Secret Gold Back currency RUINING Biden’s plans for a digital dollar?