Plus our 3 favorite green energy stocks for 2024

In the smoke-filled backdrop of the 19th-century Industrial Revolution, where coal was king, and steam-powered titans roared to life, one man dared to imagine a different future. Sir William Grove, a Welsh judge, and scientist, known more for his quiet demeanor than grandiose inventions, embarked on a journey that was far ahead of its time. In 1839, amidst the clanging of metal and hissing of steam engines, Grove invented the first fuel cell. He demonstrated that energy could be produced through simple electrochemical reactions, using resources like hydrogen and oxygen.

While the world around him was entranced by the newfound power of fossil fuels, Grove saw further. He envisioned a world not shackled by coal and smoke but powered by clean, efficient, and perhaps limitless energy. His “gas voltaic battery” barely made a whisper in the industrial clamor of his time, and it would take over a century for his vision to resonate. But resonate it did, as today, Grove’s principles form the foundation of fuel cell technology, a cornerstone of the emerging green energy landscape.

Grove’s legacy is a testament to visionary resilience. He faced the derision of his contemporaries, many of whom failed to see beyond the immediate gratification of the industrial age. Yet, he planted the seeds for a revolution that we are now witnessing – a shift towards an era of sustainable energy, driven by necessity, ethics, and the very survival of our planet.

The Green Energy Movement: From Obscurity to Necessity

The journey of green energy from a scientific outlier to a global imperative has been tumultuous. The oil crises of the 1970s awakened the world to its dangerous addiction to fossil fuels. However, it wasn’t until the turn of the millennium that a global consensus began to form, crystallized by alarming evidence of climate change. The Paris Agreement of 2015 marked a global commitment, but the real momentum has been building recently, as the impacts of climate change become increasingly tangible worldwide.

Legislative Leverage: The U.S. Government’s Green Gamble

Recent years have seen a legislative avalanche from the U.S. Government to back ESG (Environmental, Social, and Governance) initiatives, a clear signal of green energy’s burgeoning prominence. The Biden Administration’s commitment to rejoin the Paris Agreement was just the starting whistle. Subsequent proposals, such as the American Jobs Plan, pledge trillions in investment, aiming to catalyze the decarbonization of the electricity sector, revolutionize transportation infrastructure, and ensure sustainable home development.

This focus is driven by recognition and necessity. Climate change is no longer a distant threat but a present crisis, evidenced by raging wildfires, crippling hurricanes, and record temperatures. The government’s legislative muscle flexing aims to curb these impacts by transitioning to a cleaner, sustainable energy matrix.

ESG: The Cornerstone of Tomorrow

The transition to green energy is not merely a precaution against environmental calamity; it represents a holistic evolution of how humanity perceives its existence on Earth. The benefits are manifold, and the implications, profound. Green energy sources like solar, wind, and hydroelectric power offer a virtually infinite supply, unlike their finite fossil counterparts. They promise a future of sustainable energy independence, where geopolitical conflicts for resources become relics of the past.

Moreover, the economic rationale is compelling. Renewable energy is becoming cheaper to produce, thanks to technological advancements and economies of scale. The International Renewable Energy Agency (IRENA) reported that solar and wind power costs reached record lows in 2020, making them more competitive than the traditional fossil fuels that have powered our societies for centuries.

But perhaps the most immediate impact of green energy is environmental. The shift to renewables signifies a cleaner, healthier world, with reduced air pollution and controlled greenhouse gas emissions. It means a decline in health issues caused by pollutants and a planet that finally can start healing from centuries of industrial onslaught.

Three ESG Stocks Poised for Prominence

- NextEra Energy, Inc. (NEE)

- Overview: As the world’s leading producer of wind and solar energy, NextEra Energy is a beacon in the ESG space. Its aggressive expansion into renewables underlines its commitment to a green future.

- Analysis: NEE’s stock has performed impressively, buoyed by its forward-thinking strategy and robust financial health. Its investment in grid modernization and battery storage solutions positions it strongly amidst the green transition.

- Tesla, Inc. (TSLA)

- Overview: Synonymous with electric vehicles, Tesla is a vanguard of the green revolution. Beyond cars, it’s pushing boundaries in clean energy solutions, evidenced by initiatives like its solar roofs and energy storage products.

- Analysis: TSLA’s market performance has been stellar, and its continuous innovation and global brand recognition make it a formidable player in the ESG arena.

- Enphase Energy, Inc. (ENPH)

- Overview: Enphase specializes in energy management solutions, producing microinverter systems for solar installations. Its technology enhances energy production, simplifies design and installation, improving system uptime and reducing costs.

- Analysis: ENPH has experienced robust growth, driven by the solar industry’s expansion and its international market penetration. Its focus on enhancing storage capabilities is a promising venture, given the increasing importance of energy reliability.

Conclusion

As we stand on the brink of an era defined by how we respond to climate change, the green energy sector represents not just a chance for redemption but a lucrative frontier for investors. Much like Sir William Grove, who saw beyond the conventions of his time, today’s investors have the opportunity to be part of a transformative journey, shaping a sustainable future for generations to come.

Where to invest $500 Right Now?

Before you consider buying any of the stocks in our reports, you’ll want to see this.

Investing legend, Marc Chaikin just revealed his #1 stock for 2024…

And it’s not in any of our reports.

During his career of nearly 50 years, Marc Chaikin was one of the quantitative minds behind some of the most famous investors in history: Paul Tudor Jones, George Soros, Steve Cohen, and Michael Steinhardt.

Even the Nasdaq hired him to create three new indices.

And now he’s going live with his #1 pick for 2024.

You can learn all about it on Mr. Chaikin’s Website, here.

Wondering what stock he’s investing in?

Click here to watch his presentation, and learn for yourself…

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream… And by then, it could be too late.

Click here to reveal the name and ticker of Marc Chaikin’s no. 1 pick for 2024…

You might also like:

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

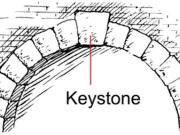

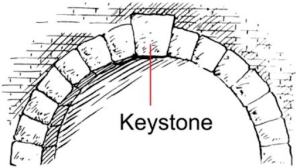

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

- No 1 Stock to Buy ASAP

- Secret Gold Back currency RUINING Biden’s plans for a digital dollar?