Data from last week showed that inflation continued to subside, which gives the Federal Reserve room to further slow the pace of its rate hikes at this week’s FOMC meeting. Market participants expect the central bank to scale back its rate hikes to 25 basis points from 50 basis points in December.

Gold prices increased this morning as the U.S. dollar pulled back while markets awaited the Fed meeting results. As gold is a non-yielding asset, it tends to benefit when interest rates are low, as it reduces the opportunity cost of holding bullion. This has contributed to gold’s success over the past few months. It may be a bumpy year, but the overall outlook for gold in 2023 is positive.

Investors looking to expand their precious metals position would do well to include operations with smaller market caps for their growth potential and as portfolio diversifiers. Today, we’re looking at one low-priced gold stock that seems well-positioned for the next leg up.

B2Gold Corp. (BTG) operates as a gold producer with three mines in Mali, the Philippines, and Namibia. As part of the long-term strategy to maximize shareholder value, B2Gold Corp. declared a fourth-quarter cash dividend of $0.04 per share (or an expected $0.16 per share annually). B2Gold expects to announce future quarterly dividends at the same level or higher.

[stock_market_widget type=”accordion” template=”extended” color=”#5679FF” assets=”BTG” start_expanded=”true” display_currency_symbol=”true” api=”yf” ]

You might also like:

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

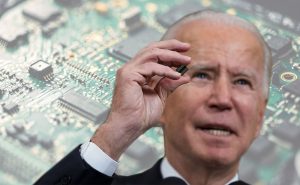

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

- No 1 Stock to Buy ASAP

- Secret Gold Back currency RUINING Biden’s plans for a digital dollar?