The hotel sector has, in recent times, been devastated by the pandemic. The negative consequences of government-mandated lockdowns, travel restrictions, and the legal prohibition of unvaccinated guests from some places have caused significant financial harm to the entire travel and hospitality industry. According to analysts, the hotel business has been struck particularly hard by the worldwide pandemic, with revenue and visitor levels not likely to recover until 2023 or later. Keeping that in mind, these would be more or less long-term investments.

On the other hand, the hotel industry is likely to rebound sooner than later, after the vaccination distribution has been finished in the majority of nations.

The hotel sector remains a profitable investment, particularly when travel restrictions gradually relax and unfulfilled holiday plans are realized. Hedge funds are putting their money into firms like MGM Resorts International (MGM), Marriott International, Inc. (MAR), Hilton Worldwide Holdings Inc. (HLT), and Hyatt Hotels Corporation (H). I’m going to switch it up a little from the big names to those that hedge funds and investors also like.

Let’s take a brief look at just three reasonably priced hotel stocks that the experts consider intelligent long-term investments for our growing portfolios:

Ryman Hospitality Properties (RHP)

Ryman Hospitality Properties, Inc. (RHP) is a REIT (Real Estate Investment Trust) that owns and operates group-oriented, destination hotel properties in various regions. Hospitality, Entertainment, and Corporate are the company’s three segments. Directly owned hotel properties and hotel operations are included in the Hospitality section. The Grand Ole Opry properties, the Ryman Auditorium, WSM-AM, Ole Red, other Nashville-based attractions, and the Circle joint venture are all part of the Entertainment sector. Edward Lewis Gaylord created the firm in 1956, and it is based in Nashville, TN.

RHP has shown very impressive year-over-year financials, indicating growth in every category. For it’s second-quarter, it easily beat analysts’ projections; EPS (Earnings-per-share) by 46.40% and revenue by 11.95%. RHP is currently expected to pay an annual dividend of 22.4 cents per share. The forecasts for both yearly and quarterly growth for EPS/Revenue are optimistic, and for the current quarter, RHP has shown us $280.6 million in sales. The consensus price target for RHP from analysts that provide 12-month predictions is 88.00, with a high of 100.00 and a low of 61.00. The median estimate reflects an increase of 4.23% over its most recent price. The consensus is also to buy shares of RHP.

Pebblebrook Hotel Trust (PEB)

Pebblebrook Hotel Trust (PEB) is an internally managed hotel investment business that purchases and invests in hotels in major American cities, with an emphasis on seaside assets. PEB is recognized for focusing on affluent customers and investing in conveniently-positioned resorts near urban regions and distinctive tourist markets. PEB currently operates in the following markets: Massachusetts, Illinois, Florida, Tennessee, Pennsylvania, California, Washington D.C., Georgia, Oregon, and more.

PEB has had a recent history of beating analysts’ projections on their earnings reports. In Q1, it beat EPS predictions by 7.18% and revenue expectations by 1.72%. It missed slightly on EPS for its second quarter but increased its revenue growth and beat projections by 4.88%. PEB currently pays a modest dividend yield of 0.18%. It is also modestly priced, however, and the forecasts look great. Analysts anticipate positive growth for both annual and quarterly EPS/Revenue. Until they report again, PEB’s current quarter shows us $221.9 million in sales. The median price target for PEB from analysts that provide 12-month price projections is 25.00, with a high of 28.00 and a low of 20.50. The median estimate reflects an increase of 14.36% over its current price. The consensus among analysts is to buy and hold PEB stock.

Host Hotels & Resorts Inc (HST)

Host Hotels & Resorts, Inc. (HST) is the largest American lodging REIT and an S&P 500 corporation. HST is a self-managed and self-administered REIT that owns and maintains luxury and “upper-upscale” hotels. Host Hotels & Resorts (HST) invests in a broad portfolio of assets, including 84 hotels in 20 major US cities. The Hotel Ownership section is where it operates. Its properties are spread across the United States but also in Brazil, Canada, and Mexico. The firm was established in 1927, and it is based in Bethesda, MD.

HST, similar to the other hotel/REIT firms listed, has a history of beating analysts’ projections on their quarterly earnings reports. They most recently surprised experts by besting their EPS estimate by 200%. For the current quarter, HST shows $790.2 million in sales. The forecasts from analysts for both quarterly and annual growth are also positive regarding all categories. They most recently paid an annual dividend of 80 cents, with an impressive yield of 4.78%. The consensus price target for HST from analysts that provide 12-month price projections is 18.50, with a high of 21.00 and a low of 15.00. The estimate reflects an increase of 9.73% from its current price. The strong consensus for HST’s stock is to buy and hold.

Should you invest in Host Hotels & Resorts Inc. right now?

Before you consider buying Host Hotels & Resorts Inc., you'll want to see this.

Investing legend, Keith Kohl just revealed his #1 stock for 2022...

And it's not Host Hotels & Resorts Inc..

Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on this tiny company that trades publicly for $5.

Keith say’s he thinks investors will be able to turn a small $50 stake into $150,000.

Find that to be extraordinary?

Click here to watch his presentation, and decide for yourself...

But you have to act now, because a catalyst coming in a few weeks is set to take this company mainstream... And by then, it could be too late.

Click here to find out the name and ticker of Keith's #1 pick...

You might also like:

- Beware Executive Order 14067

- #1 AI Stock for 2024 and Beyond

- Bank plague 2024

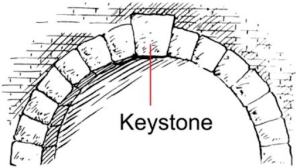

- Gates, Bezos, and Buffett invest in AI Keystone

- Congress Just Fast-tracked New A.I. Energy Breakthrough

- Elon Musk: THIS will be bigger than Tesla

- EV charging stations that pay you up to $93/day!

- Legendary Wall Street Stock-Picker Names #1 A.I. Stock of 2024, Live On-Camera

- No 1 Stock to Buy ASAP

- Secret Gold Back currency RUINING Biden’s plans for a digital dollar?